We are Lost in the Present When We Don’t Know Our Past

What are the Stakes When Political Candidates Don’t Know Our History?

We are in 2024, an election year, a year I call “the Year of the Precipice” for our democracy. We are now examining forces in our politics that are abnormal to democracy but have come to seem normal to many of us. I call them “democracy destroyers”.

A Warning Sign for Democracy

Americans’ poor civic literacy of our government and their civic responsibilities is only exceeded by our poor historical literacy. And this lack of historical thinking matters. It can matter greatly. How so?

Poor Historical Knowledge Damages Our Critical Thinking

In a democracy, historical facts should matter to its citizens. To be able to critically think in the context of our nation’s fluid public square and make sense of it, one must accurately know what happened and why. Historical ignorance means we have little to no context to understand what’s going on around us. Without accurately knowing and understanding our past, we can’t understand our present.

Americans’ Historical Knowledge

Sadly, evidence of our poor historical knowledge is everywhere. Saba Naseem, writing for the Smithsonian Magazine put forth as evidence of our dearth of historic knowledge a 2014 National Assessment of Education (NAEP) survey which found only eighteen percent of U.S. eight graders were “proficient or above” in U.S. history.[1] In 2022 this same assessment found that the average U.S. history score at eighth grade decreased by five points compared to 2018 and by 9 points compared to 2014.[2]

The Institute for Citizens & Scholars’ former President Arthur Levine commented, “Knowledge of the history is fundamental to maintaining a democratic society, which is imperiled today.”[3] Stephen Dinan of The Washington Times commenting on these survey results said, “…It’s probably lucky that most Americans are granted citizenship at birth- a new study suggested that they wouldn’t be able to pass the citizenship test if they had to…”[4] (emphasis mine)

What if the Stakes are Raised?

Knowing historically documented facts such as the cause of our Civil War (which recently former GOP presidential candidate Nikki Haley demonstrated she did not know) matters greatly.[5] But, what if a candidate that actually attains elected office is historically illiterate and demonstrates repeatedly, they have no interest in improving their historical knowledge? What if that lack of historical knowledge could affect over 330 million Americans’ lives in a direct and demonstrable manner with their policy decisions and lawmaking?

Recently, GOP presidential candidate (again) Donald Trump proposed eliminating the federal income tax and replacing that revenue with income from tariffs and existing tariff increases (i.e., a tax on imported goods).[6] Most analysis indicates this could have a devastating impact on the U.S. economy and raise Americans’ cost of living by increasing rates of inflation over those that exist today. Plus, the “math doesn’t work”. Tariffs were a revenue source for the federal government when it was much smaller, but not anymore.[7] But, what if presidential candidate Trump had examined the historical record first before making this proposal? What would he have found?

1828- One of Our First Big Tariff “Dustups”

Earlier in U.S. history, tariffs represented a far larger share of the federal government’s revenue that it does today. Nonetheless, tariffs and their impact, have created more than their share of turbulence in American history.

The Tariff Act of 1828 put in place the highest tariffs this country had seen. The driving force for Congress passing this tariff legislation followed Europe’s Napoleonic Wars with its blockade of Europe. This forced British manufacturers to flood the U.S. market with cheaper exports. Northeast U.S. manufacturers’ goods became price uncompetitive making them strong proponents of high import tariffs to protect their market. Conversely, Southern interests viewed these tariffs as an “abomination” because it increased the price of British goods imported by Southern markets. Southerners also believed these tariffs would reduce Britain’s ability to buy Southern cotton since the tariffs would reduce cash generated from American demand for British goods.[8]

The State of South Carolina called this the “Tariff of Abomination”, claimed it was unconstitutional, and set out to “nullify” it (spoiler alert- this was a Civil War “sneak preview”). It created a huge crisis over the federal government’s constitutional authority to impose these tariffs leading to conflict with then President Andrew Jackson. The conflict only dissipated with Jackson’s threat of military force against South Carolina to require it to collect these tariffs. Eventually political compromise did cool the crisis with the passage of the Tariff Act of 1833 which reduced the tariffs over time.[9]

But the Tariff Act of 1828 pales in its impact compared to the next big tariff move by the federal government.

Enter the Smoot-Hawley Act

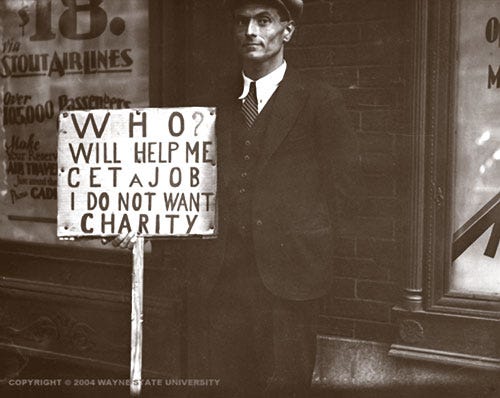

We jump now from 1828 to 1930. With the worst economic depression now in full swing devastating the U.S., a priority of the federal government had become protecting American jobs and farmers from foreign competition. In response to this sentiment, Senator Reed Smoot (R-UT) and Congressman Willis C. Hawley (R-OR) introduced the Tariff Act of 1930, most often called the Smoot-Hawley Act (the Act). The Act raised U.S. tariffs on over 20,000 imported goods and enacted the second highest tariffs in U.S. history, exceeded only by the tariffs of 1828.[10]

While having some positive impact initially, economic historians’ consensus view is that the Smoot-Hawley tariffs worsened the effects of the Great Depression.[11] Even before the Act was signed into law, more than 1,000 economists urged (sine even begged) President Hoover to veto it.[12] Canada and other nations, prompted by the Act and its retaliatory tariffs, were major factors in the reduction of American exports and imports by 67% during the Great Depression.[13]

The Smoot-Hawley tariff increases strained the economies of countries that were already suffering from the Great Depression as well as rebuilding costs resulting from World War I. Germany suffered greatly from this trade war as it was already struggling to repay war reparations to the U.S. and other nations that had been victorious.[14] Some believe this tariff induced trade war helped ease the way for the ascension to power of Adolf Hitler and his Nazi party there.

Some said it turned the 1930s depression from just a depression into the Great Depression. Here’s proof of what these tariffs contributed to in U.S. in terms of economic performance during this period:[15]

· “…U.S. imports decreased 66% from $4.4 billion (1929) to $1.5 billion (1933), and exports decreased 61% from $5.4 billion to $2.1 billion.

· GNP fell from $103.1 billion in 1929 to $75.8 billion in 1931 and bottomed out at $55.6 billion in 1933.

· Imports from Europe decreased from a 1929 high of $1.3 billion to just $390 million during 1932, and U.S. exports to Europe decreased from $2.3 billion in 1929 to $784 million in 1932. Overall, world trade decreased by some 66% between 1929 and 1934.

· Unemployment was 8% in 1930 when the Smoot–Hawley Act was passed, but the new law failed to lower it. The rate jumped to 16% in 1931 and 25% in 1932–1933…”[16]

The Latest Tarriff and Economic Impact Proposals

Knowing what we know about our tariff history, let us “fast forward” to today.

While Trump used tariffs when he was president, especially against China, they are now looming even larger for America. According to historian Heather Cox Richardson, Donald Trump has proposed, given a second term, eliminating the federal income tax, and replacing it with revenue from across-the-board tariff increases. However, there is more. Trump “…has promised to slash taxes on the wealthy, increase tariffs across the board, and deport at least 11 million immigrant workers.”[17]

According to Richardson, “…Moody’s Analytics, which evaluates risk, performance, and financial modeling, compared the economic promises of President Joe Biden and presumptive Republican nominee Donald Trump…concluded that while a second Biden presidency would see cooling inflation and continued economic growth of 2.1%, a Trump presidency would be an economic disaster.”[18] (emphasis mine)

Richardson went on to report that Moody’s Analytics has determined:

“…these policies (i.e., of Trump’s) would trigger a recession by mid-2025. The economy would slow to an average growth of 1.3%. At the same time, tariffs and fewer immigrant workers would increase the costs of consumer goods. That inflation—reaching 3.6%—would result in 3.2 million fewer jobs and a higher unemployment rate. Trump’s proposed tariffs would not fully offset his tax cuts, adding trillions to the national debt. “[19] (emphasis mine)

Knowing our History on Tariffs- Are We Feeling Lucky?

It begs the earlier question, but we will ask it again a little differently. Did presidential candidate Trump examine the historical record first before making his tariff proposal? Did he have any economic analysis on its impact done before he made his proposal? Does he understand the “math” behind it? Is historical literacy or historical illiteracy in play here?

Of course, if you don’t care that there will be less revenue by carrying out Trump’s massive tariff increases and income tax elimination proposal, and that this revenue loss will require significant government service reductions, then increasing tariffs to eliminate the income tax makes sense to candidate Trump and his supporters. It can be part of Trump’s presidential agenda, if elected. In that case, knowing the lessons of our history doesn’t matter. That’s because knowing our history’s lessons- in this instance the lessons of 1930s Smoot-Hawley tariffs, aren’t even a consideration because they were never a part of Trump’s governance objective.

Or are We Willing to be “Bamboozled” Again?

Truth be told, there is no “governance objective” here. Governance is not an objective of even the remotest interest here. The only objective of this tariff proposal is power- power at any cost, especially at the expense of the average American citizen, and especially to the gain of America’s billionaire cabal.

As the late Carl Sagan explained:

“One of the saddest lessons of history is this: If we’ve been bamboozled long enough, we tend to reject any evidence of the bamboozle. We’re no longer interested in finding out the truth. The bamboozle has captured us. It’s simply too painful to acknowledge, even to ourselves, that we’ve been taken. Once you give a charlatan power over you, you almost never get it back.”[20] (emphasis mine)

Are we willing to allow historical illiteracy to bamboozle us again? Or, in the words of the Who’s Pete Townsend, are we willing to say-

“…I’ll get on my knees and pray; we won’t get fooled again!”[21]

(emphasis mine)

I choose the second option. To achieve that, we must choose to know something about our history, mistakes made, and learn from them.

We will continue exploring topics like this that are not given near enough time and emphasis in our civic education efforts, if they are even taught at all. Democracy is so important. But it’s hard to keep, and it’s easy to lose. It’s up to us, and only us, to protect it. Support democracy, become a Democratist! Spread the word! Please share this Democraticus with others! For more information, go to www.tomthedemocratist.com

[1] “How Much U.S. History Do Americans Actually Know? Less Than You Think,” by Saba Naseem, May 28, 2015, Smithsonian Magazine, https://www.smithsonianmag.com/history/how-much-us-history-do-americans-know-less-than-you-think-180/955431

[2] Assessments - U.S. History | NAEP (ed.gov)

[3] Ibid, //woodrow.org/news/national-survey-finds-just-1-in-3-americans-would-pass-citizenship-test/

[4] “Most Americans Would Fail U.S. Citizenship Test, Study Finds,” by Stephen Dinan, The Washington Times, October 3, 2018, https://www.washingtontimes.com/news/2018/oct/3/most-americans-would-fail-citizenship-test-study/

[5] Presidential candidate Nikki Haley left out slavery when asked what caused the Civil War. Then she backtracked | PBS NewsHour, December 28, 2023, 11:45 AM EST.

[6] Trump Wants to Eliminate Income Taxes: Here’s What That Would Mean for the Economy and Your Wallet (yahoo.com)

[7] Trump Income Tax and Tariff Proposals: Details & Analysis (taxfoundation.org)

[8] Tariff of Abominations - Wikipedia

[9] Tariff of Abominations - Wikipedia

[10] Smoot–Hawley Tariff Act - Wikipedia

[11]Smoot–Hawley Tariff Act - Wikipedia

[12] What Is the Smoot-Hawley Tariff Act? History, Effect and Reaction (investopedia.com)

[13] Smoot–Hawley Tariff Act - Wikipedia

[14] What Is the Smoot-Hawley Tariff Act? History, Effect and Reaction (investopedia.com)

[15] Smoot–Hawley Tariff Act - Wikipedia

[16] Smoot–Hawley Tariff Act - Wikipedia

[17] Letters from an American, by Heather Cox Richardson, June 23, 2024, Copyright 2024.

[18] Letters from an American, Ibid.

[19] Letters from an American, Ibid.

[20] The Demon-Haunted World, by Carl Sagan, Carlsagan.com

[21] The Who – Won't Get Fooled Again (1971, Solid Centre, Paper Labels, Vinyl) - Discogs and won't get fooled again lyrics - Search (bing.com)